How the Gann Limit Interacts with Cap-and-Trade

Overview

This article explores whether California should include revenue from its cap-and-trade program in the state’s appropriations limit.

California voters enacted Article XIII B of the state constitution in 1979 (Proposition 4) to constrain state and local spending. That provision limits state appropriations to 1978 spending levels, plus the growth of the state’s population and personal income. This is commonly called the “Gann Limit,” after the measure’s author, conservative political activist Paul Gann. It applies to spending from tax revenues and other proceeds, including regulatory licenses, user charges and fees, and tax revenue investment. The state reached the Gann Limit once in the 1980s, but since then it has been a relatively minor part of the state’s budget process, due to economic growth and subsequent ballot measures. Today, however, due to increasing state spending and the continued economic expansion, state spending is inching closer to this limit.

California’s cap-and-trade (CAT) program is the state’s newest revenue source. In 2006, the state enacted it to lower the state’s greenhouse gas emissions. This program generates significant revenues by auctioning permits to emit greenhouse gas. CAT auction revenue is likely to increase in the near future, due to the program’s recent extension and the state’s aggressive greenhouse gas reduction targets. To date there has been no analysis of whether CAT auction revenue fits under the Gann Limit. Currently, the state Department of Finance does not classify it as tax revenue, nor does the state count this revenue under the Gann Limit.[1]

The Issue: How the Gann Limit and CAT Revenue Interact

This article reviews CAT revenue’s characteristics and concludes that it should not be included as revenue under the Gann Limit.[2] Revenue from selling a public asset could be a tax, a fee, or something else. The state’s CAT auctions are a unique and not easily-classifiable transaction: the state trades an allowance to pollute (which has a market value) for revenue. As discussed below, CAT revenue is best excluded from the Gann Limit because it is unrelated to the electorate’s intent of lower taxes and reduced spending, and because including it would achieve the dubious public policy goal of discouraging creative legislative solutions like a market-based solution to combat climate change.

- Cap-and-Trade

In 2006, California’s Global Warming Solutions Act established the state’s CAT program.[3] Under this program, the California Air Resources Board establishes a statewide greenhouse gas emission cap and issues a set number of permits to allow greenhouse gas emissions. Companies may purchase these permits at state-run auctions.[4] The program allows market forces to set the price of a pollution permit based on the supply of permits and companies’ need to pollute. Compared with a carbon tax or alternative regulations, CAT is a low-cost regulatory framework to address greenhouse gas pollution.[5] Economic theory posits that the market for permits encourages companies to reduce pollution.[6]

The state’s permit auctions collect significant revenue, and it is rising. In last year’s budget, the state appropriated $1.4 billion in auction revenue.[7] The 2017–18 budget appropriates $2.6 billion in auction revenue. From 2015 to 2017, the state generated $5 billion from these auctions.[8] The legislature directs this spending to various climate change abatement projects, including programs for transportation, housing, and low-income Californians.[9]

Recent state policy changes are likely to significantly increase CAT auction revenue. In 2016, the state enacted a new and aggressively low greenhouse gas emissions target: By 2030, California aims to reduce greenhouse gas emissions to 40 percent lower than 1990 levels.[10] The state will issue fewer greenhouse gas pollution permits to meet this target. Next, the state extended its CAT program through 2030.[11] Together, these new policies will lower the supply of permits but increase the demand for them. Pollution allowance prices will rise, increasing state revenue. At slightly above current auction prices, the Legislative Analyst’s Office estimated that CAT auction revenue could be between $2.5 and $3 billion.[12] Permit prices at the state’s most recent auction for the last quarter of 2017 reflect this change.[13] Prices were the highest in the program’s history as companies bought an estimated $862 million worth of permits.[14] With the increasing demand for permits along with their deceasing supply, future auction revenues may be substantially higher. The Legislative Analyst’s Office estim,ates that auction revenue by 2030 could range from $2 billion to $7 billion.[15]

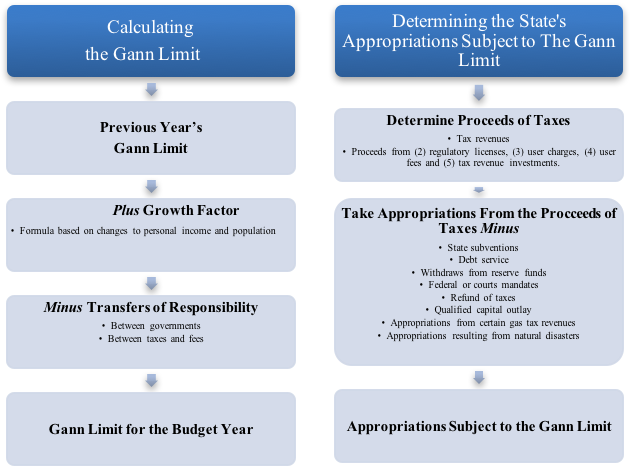

The Gann Limit is a multiple-step equation to calculate the maximum amount the state can spend in a given fiscal year. First, the state must determine all proceeds of taxes “levied by or for the state.”[16] The state’s “proceeds of taxes” are broadly defined and include (but are not restricted to) all tax revenues and the proceeds from regulatory licenses, user charges, and user fees.[17] The Gann Limit’s definition of the “proceeds of taxes” differs from other tax definitions in the California constitution.[18] Next, the state determines all budget appropriations from these sources.[19] Some spending is exempt, including state subventions to local governments, appropriations for debt service, and appropriations for qualified capital outlay projects (as defined by the legislature).[20] Last, appropriations subject to this limit are compared to a baseline spending amount. This baseline amount equals the prior year’s spending limit plus adjustments for changes in state personal income and population.[21] Breaching the Gann Limit has significant consequences for state spending. If appropriations exceed the baseline in two consecutive years, the state must split the spending above the baseline by providing half to public schools and the other half to taxpayers.[22]

The calculation process looks like this:

Since the 1980s, state spending has been far below the Gann Limit.[23] This is because later initiatives loosened the limit, and the state diverted spending subject to this limit to local governments by transferring responsibility for certain programs and their funding to them.[24] But due to the state’s economic expansion, state spending today is approaching the Gann Limit ceiling.[25] The 2013–14 budget was $18 billion under the spending limit.[26] In 2017–18, spending is only $6 billion or so under the limit: the appropriations limit is estimated at $103.39 billion, while state spending subject to the limit is $97.3 billion.[27] Before the 2017–18 budget was enacted, the governor and the legislature initially clashed over the methodology for calculating the Gann Limit.[28] This previews a future when the state gets closer to breaching the limit. The closer the state gets to the limit, the more it matters whether CAP revenue should be counted under the Gann Limit.

This means the state needs an answer to the question about whether CAT revenue should count under this limit. The state constitution does not provide a clear answer. If this revenue is counted under the Gann Limit, the state would have to reevaluate the CAT program specifically, and spending generally: either reducing spending over the limit, reallocating it, or disbursing it to schools and taxpayers. This will impair the state’s ability to fund climate change abatement policies, and create difficult fiscal policy choices.

- Cap-And-Trade Auction Proceeds Should Not Be Included Under the Gann Limit

Starting with a textual analysis, cap-and-trade auction proceeds do not fairly fit within any of the Gann Limit’s categories. Article XIII B describes five revenue categories: (1) tax revenues; (2) proceeds from regulatory licenses; (3) user charges; (4) user fees; and (5) tax revenue investments.[29] CAT auction proceeds fall within none of those categories. Instead, auction proceeds stem from a transaction for a valuable commodity that gives businesses the right to pollute. No one could contend that the auction proceeds are income from tax revenue investments, so we need only consider whether the proceeds are revenue from taxes or from user licenses, charges, or fees.

Auction proceeds are not a tax.[30] A tax is a compulsory payment where the payer receives nothing of value.[31] CAT program auctions do not fit in this category because the buyer receives something of value in a marketplace exchange.[32] Furthermore, purchasing a CAT permit is voluntary, while taxes are compulsory.

Auction proceeds also cannot be classified under any of the other government proceeds listed in Article XIII B. Auction revenues are not an excessive regulatory license. A regulatory license is a formal approval allowing an entity to conduct a regulated activity.[33] Auction proceeds could possibly be categorized as a type of regulatory license: a permit conveying the privilege to pollute greenhouse gas.[34] But the Gann Limit only includes “excessive” regulatory licenses.[35] The reverse is true for CAT permits: the social cost of carbon is significantly higher than the CAT auction price.[36] And the auction price fluctuates according to market forces. Thus, it is impossible to determine if the price a company pays for a pollution permit is excessive.

CAT auction proceeds do not have the characteristics of a user fee or user charge, because these proceeds are a permit to conduct a regulatory activity, rather than a payment to offset the cost of a government service.[37] Instead, CAT provides the state with revenue based on the sale of a valuable commodity: a property right to emit greenhouse gas pollution.[38] Companies purchase this right voluntarily to mitigate the impact of the purchaser’s business operations.

CAT revenue is unlike any revenue source the state has previously collected. Because CAT revenue does not fit within any of Article XIII B’s textual categories, the state should not be required to include that revenue when calculating the Gann Limit.

The intent behind the Gann Limit also does not support including CAT revenue. Article XIII B contains an undefined catch-all phrase stating that proceeds subject to the Gann Limit “include, but [are] not . . . restricted” to the listed revenue sources. Even if this catchall makes Article XIII B’s text unclear, the electorate could not have intended to include CAT revenue. The primary goal when interpreting an initiative is to effectuate the electorate’s intent. A court will look first to the voter’s intent as expressed in the ballot pamphlet.[39] The ballot arguments here contain nothing to indicate that state auction proceeds are included.

Cap-and-trade auction proceeds are nowhere mentioned in the ballot pamphlet for Proposition 4; obviously, they had not been invented yet. Cap-and-trade proposals did not exist until a decade after voters approved the Gann Limit.[40] Voters cannot anticipate new forms of revenue.[41] The 1979 voters aimed their fiscal policymaking power only at limiting the state’s taxing and spending. Because the Gann Limit’s authors and voters could not have anticipated (either in fact or as a matter of law) CAT program revenue, there is no basis for inferring an intent to include what would have been imaginary money at the time.

The canons of interpretation support excluding auction revenues from the Gann Limit, because those auction revenues are nowhere in the constitution’s text.[42] California courts narrowly construe the state constitution’s fiscal limits when the proposed limit has no textual support.[43] This narrow construction of the constitution’s fiscal limitations also applies when these limitations conflict with the legislature’s powers.[44] Similarly, the Gann Limit restricts spending on enumerated taxes and fees, but not other revenue-raising techniques. Instead, the legislature has the power to design policies outside of the Gann Limit’s constraints. The legislature’s power is to do anything not prohibited by the state constitution, so here doubts should be resolved in the legislature’s favor.[45]

CAT revenue is not included in any of Article XIII B’s categories, and cap-and-trade did not yet exist when the Gann Limit was enacted. Thus, voters could not have intended to include CAT auction revenue. Courts narrowly interpret the state’s fiscal limitations in the constitution. Accordingly, CAT auction revenue should not be included under the Gann Limit.

Limited government advocates no doubt will argue that, notwithstanding the problems discussed above, CAT revenue should be included in the Gann Limit because voters enacted Proposition 4 to reduce government spending, and including this revenue in the limit would promote that aim. No one doubts that voters in 1979 enacted the Gann Limit to constrain state spending.[46] The Gann Limit’s revenue definitions are not exclusive; instead, revenue counted under this limitation includes, but is not restricted to, taxes and fees. While auction proceeds are not a tax or fee, this argument goes, they are at least a government program that raises revenue and increases state spending.[47]

This argument fails for two reasons. Cap-and-trade did not yet exist when the voters enacted Proposition 4. And the CAT program furthers the Gann Limit’s limited government purpose. California could have chosen a variety of ways to limit greenhouse gas emissions, like increasing the regulatory, inspection, and compliance burden by creating a bureaucracy to enforce a ban on emissions or a carbon tax.[48] Instead, CAT is a market-based, Coasian solution.[49] Cap-and-trade limits the total amount of pollution that companies can emit and encourages them to either pollute less or to buy credits to pollute. Including CAT auction revenue in the Gann Limit would distort the voters’ intent to limit government spending and misapplying that intent to estop a small-government, pro-market policy to combat climate change.[50]

Conclusion

California’s CAT system was not primarily designed to raise revenue; instead, it attempts to lower the state’s greenhouse gas emissions. The program’s success is not measured by the amount of revenue raised but by the amount of greenhouse gas emissions reduction. Those are not the goals underlying a tax or fee, which have only one purpose: to raise revenue to fund government services. Nevertheless, this system is flush with cash. With CAT’s recent reauthorization, the state will likely see a significant increase in CAT auction proceeds and spending on climate abatement programs. This means that a dispute about whether the California constitution’s structural impediments on state spending apply to CAT revenue is coming into focus. Voters enacted the Gann Limit to produce smaller government, lower taxes, and less spending. Those voters could not have anticipated including CAT, because CAT did not exist. In any event, this market-based solution fosters those small government goals: instead of forcing companies to cease polluting through regulation or taxation, CAT creates a marketplace to allow companies to purchase the right to pollute.

Accordingly, CAT spending should not be included in the Gann Limit. Doing so would constrain the state’s marquee climate program and the spending associated with it. It would also be the death knell of the legislature’s power to create novel solutions to complex problems.

Ben Gevercer is a research fellow with the California Constitution Center and a third-year law student at the UC Davis School of Law.

[1] California Department of Finance, Manual of State Funds (2012).

[2] In a related context, the Court of Appeal held that CAT is not a tax or fee under Proposition 13. California Chamber of Commerce v. State Air Resources Board (2017).

[3] Cal. Health and Safety Code § 38500 et seq.

[4] See Cal. Code Regs., tit. 17, § 95911, subds. (a), (e).

[5] Jonathan Gruber, Public Finance and Public Policy 137–47 (2013).

[6] Id.

[7] The 2017–18 Budget: California Spending Plan, Legislative Analyst’s Office 49 (Oct. 18, 2017) (hereinafter 2017–18 Cap-and-Trade Spending).

[8] 2017–18 Cap-and-Trade Expenditure Plan, Legislative Analyst’s Office (Aug. 24, 2017).

[9] Id.; see also Cal. Health and Safety Code §§ 39713, 39716.

[10] Cal. Health and Safety Code § 38566.

[11] This reauthorization received a two-thirds legislative majority. The California constitution requires the legislature to enact taxes and fees with a two-thirds legislative majority. See California Chamber of Commerce, supra note 2. Thus, although courts have not classified CAT revenue as a tax or fee, if that position changes the supermajority approval should insulate the program from challenge. David Gamage & Darien Shanske, Using Taxes to Improve Cap and Trade, Part II Efficient Pricing, State Tax Notes, 808–09 (Sept. 5, 2016).

[12] See 2017–18 Cap-and-Trade Spending, supra, note 8.

[13] Liam Dillon, California’s Most Recent Cap-And-Trade Permit Auction Raises More Than $800 Million, L.A. Times (Nov. 21, 2017, 12:51 PM).

[14] Id.

[15] Cap-and-Trade Extension: Issues for Legislative Oversight, Legislative Analyst’s Office 16-17 (Dec 12, 2017).

[16] Cal. Const., art. XIII B, § 8.

[17] Id. at § 8(c).

[18] Compare Cal. Const., art. XIII B § 8(c) (“Proceeds of taxes” shall include, but not be restricted to, all tax revenues and the proceeds to an entity of government, from (1) regulatory licenses, user charges, and user fees to the extent that those proceeds exceed the costs reasonably borne by that entity in providing the regulation, product, or service, and (2) the investment of tax revenues.”), with Cal Const., art. XIII A, § 3 (“‘Tax’ means any levy, charge, or exaction of any kind imposed by the State).

[19] Id. at § 8(b).

[20] Id. State subventions are “money received by a local agency from the state, the use of which is unrestricted by the statute providing the subvention.” Cal. Gov. Code § 7903. In 1988, Proposition 98 amended the return of revenue provision to also return excess revenues to schools. In 1990, Proposition 111 changes certain factors to calculating the limit and making the trigger a 2-year period and the methods of revenue distribution. Additionally, a qualified capital outlay project is “a fixed asset (including land and construction) with a useful life of 10 or more years and a value which equals or exceeds one hundred thousand dollars.” Gov. Code § 7914.

[21] Cal. Const., art. XIII B, § 8(h).

[22] Id. at § 2.

[23] The 2017–18 Budget: Governor’s Gann Limit Proposal, Legislative Analyst’s Office 5 (2017) (Hereinafter 2017–18 Gann Limit).

[24] Two examples of the state reallocating spending to not count under the Gann Limit are 1991 and 2011 Realignment. See e.g., The 2013–14 Budget: Examining the State and County Roles in the Medi-Cal Expansion, Legislative Analyst’s Office (2013) 7. However, local governments are also subject to their own Gann Limits. See Cal. Const., art. XIII B.

[25] 2017–18 Gann Limit, supra 22, at 18.

[26] State Public Works Board of California, Preliminary Official Statement Dated October 17, 2017, A-59 (Oct. 17, 2017).

[27] Id.; Ch. 14, § 12.

[28] 2017–18 Gann Limit, supra, note 22.

[29] Cal. Const., art. XIII B, § 8(c).

[30] California Chamber of Commerce v. State Air Resources Board at 614 (2017).

[31] Id. at 614.

[32] While Chamber of Commerce did not involve the Gann Limit’s definition of tax revenue, courts treat claims under this limit in a similar manner as Article XIII A claims. See Trend Homes, Inc. v. Central Unified School Dist. at 115 (1990) (“If a fee is not a special tax within the meaning of article XIII A, it is not the type of revenue intended to be controlled by article XIII B.”); see also Russ Bldg. Partnership v. City and County of San Francisco at 1507 (1987).

[33] U.S. v. Mittelstaedt at 1220 (1994).

[34] California Chamber of Commerce v. State Air Resources Board at 646 (2017).

[35] Oildale Mut. Water Co. v. N. of the River Mun. Water Dist. at 1633 (1989).

[36] See Supplemental Letter Brief v. California Air Resources Bd., 2016 CA App. Ct. Briefs LEXIS 1406 at p. 5–6.

[37] California Chamber of Commerce v. State Air Resources Board at 637 (2017).

[38] The state auctions off other real and personal property, and some of the revenue is deposited in the state’s General Fund. See e.g., Rev. and Tax Code § 7931; Gov’t Code § 11011.21. The state doesn’t disclose whether these auction revenues are calculated as part of the limit, though this amount likely are too small to make a difference in breaching the limit.

[39] Robert L. v. Superior Court at 905 (2003).

[40] See Richard Conniff, The Political History of Cap and Trade, Smithsonian Magazine

(2009).

[41] Courts do not presume that voters intend an initiative to “effect a change in law that was not expressed or strongly implied in either the initiative’s text or the analyses and arguments in the official ballot pamphlet.” People v. Valencia at 364–68 (2017).

[42] See Wildlife Alive v. Chickering at 195 (1976) (expressio unius est exclusio alterius: when exceptions to a general rule are specified, other exceptions are not implied or presumed).

[43] Rider v. City of San Diego at 1042–43 (1998) (narrowly reading the constitutional two-thirds vote requirement and holding it did not Joint Power Authorities because they were not expressly mentioned in the constitution).

[44] Amador Valley Joint Union High School District v. State Board of Equalization at 1300 (1978) (deferring to the legislature interpretations of Proposition 13’s to implement the initiative); California Redevelopment Assn. v. Matosantos at 262–63 (2012) (holding that the constitutional limitation on the state’s ability to require payments from redevelopment agencies for the state’s benefit did not impede on the legislature’s power to eliminate local redevelopment agencies).

[45] Howard Jarvis Taxpayers Assn. v. Padilla at 498 (2016) (“it is well established that the California Legislature possesses plenary legislative authority except as specifically limited by the California Constitution.”)

[46] Voter Information Guide, Special Statewide Elec. analysis of Prop. 4 by Legis. Analyst 16 (Nov. 6, 1979). The ballot argument in favor of the Gann Limit stated that it would “limit state and local government spending.” Arguments in Favor of Proposition 4 [argument signed by Paul Gann, a chief proponent of Propositions 13 and 4, and Assemblywoman and Assembly Minority Leader Carol Hallett], Ballot Pamp., Proposed Amend. to Cal. Const. with arguments to voters, Special Statewide Elec. 18 (Nov. 6, 1979). Barratt American Inc. v. City of Rancho Cucamonga at 701 (2005) (“[A]rticle XIII B is directed at controlling government spending”).

[47] California Chamber of Commerce v. State Air Resources Board at 639 (2017).

[48] See Michael Wara, California’s Energy And Climate Policy: A Full Plate, But Perhaps Not A Model Policy, Bulletin of the Atomic Scientists 32 (2014) (estimating the costs of per ton of carbon under California’s cap and trade program is $11 to $12 per ton, while the cost modeled in other regulatory programs is $30 to $50 per ton for the Low Carbon Fuel Standard and $133 per ton for the Renewable Portfolio Standard regulations).

[49] See Gruber, supra note 5. Previously, federal cap-and-trade regulations of the chemical causing acid rain was enormously successful. Id. at 154–55.

[50] See David Gamage & Darien Shanske, The Trouble with Tax Increase Limitations (2013) Albany Gov’t L. Rev. 50, 71–72 for a discussion of how state tax-increase limitations may have little utility compared to previous rules limiting government.